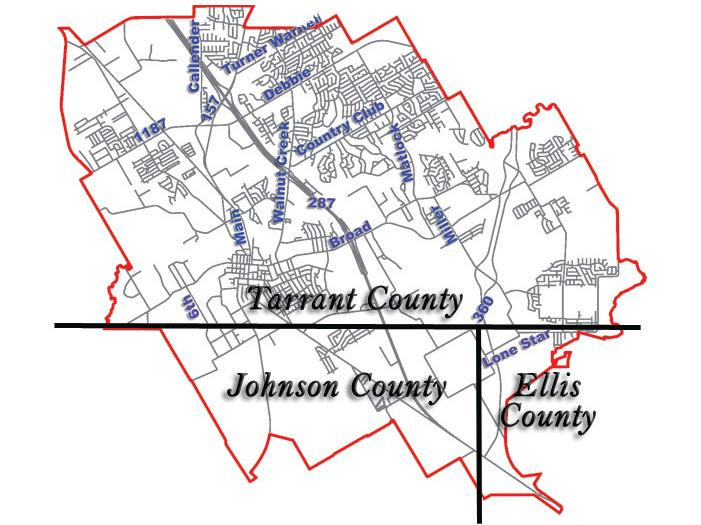

Mansfield is located primarily in Tarrant County, along with sections of Johnson and Ellis Counties. This results in three different taxing jurisdictions, with various districts within each county affecting the total tax rate.

Below are the current tax rates broken down by county (2/23/2012). These rates are subject to change and must be verified with the county for final tax estimates.

Mansfield Tax Rates by County

Mansfield ISD | $1.1469 |

Tarrant County | $0.1875 |

Hospital District | $0.1825 |

College District | $0.11228 |

City of Mansfield | $0.645 |

Total | $2.27418 |

Mansfield ISD | $1.1469 |

Johnson County | $0.329276 |

Lateral Road | $0.05 |

City of Mansfield | $0.645 |

Johnson Co ESD | $0.057513 |

Total | $2.228689 |

Midlothian ISD | $1.0769 |

Ellis County | $0.255357 |

Lateral Road | $0.018635 |

City of Mansfield | $0.645 |

Total | $1.995892 |

Mansfield Appraisal Districts

Each county in Texas has its own appraisal district, governed by a board of directors, to determine fair market values on property for tax assessment purposes, administer exemptions, update tax collectors, and make necessary changes to property records.

The city, county, and school district are all allowed to tax the same property. Instead of having all three of these perform an appraisal function, the Central Appraisal District appraises the property uniformly, collects the entire tax, and allocates the tax to each government entity in accordance with that entity’s rate.